Open IPO

Open IPO

2/6/2026

PAN HR Solution Limited, a specialized B2B manpower provider with over 10,000 personnel deployed nationwide, has launched its ₹17.04 crore SME IPO. With a price band of ₹74 to ₹78, this blog analyzes the company’s transition to a high-margin "Pay and Collect" model, its 99% revenue dependency on top clients, and the current flat GMP status.

Upcoming IPO

Upcoming IPO

2/6/2026

Aye Finance, a prominent NBFC backed by Google’s parent company Alphabet (via CapitalG) and Elevation Capital, is set to open its ₹1,010 crore IPO on February 9, 2026. This blog covers the fixed price band of ₹122–₹129, the company’s "cluster-based" lending model, and the latest Grey Market Premium (GMP) signals.

Upcoming IPO

Upcoming IPO

2/3/2026

Brandman Retail Limited, a premier distributor of global athleisure brands like New Balance and Salomon, is launching its ₹86.09 crore SME IPO tomorrow, February 4, 2026. With an asset-light model and a massive 153% jump in profit, this post explores the company’s "Sneakrz" multi-brand strategy and whether the ₹2.81 lakh entry price is worth the stride.

Upcoming IPO

Upcoming IPO

2/2/2026

Biopol Chemicals Limited, a leading manufacturer of specialty chemicals for textiles, home care, and agriculture, is launching its ₹31.26 crore SME IPO on February 6, 2026. This blog breaks down the company’s strong financial trajectory, its transition from the legacy "United Chemical Company," and the key risks and rewards for investors looking at the chemical sector.

Upcoming IPO

Upcoming IPO

2/2/2026

Grover Jewells Limited, a Delhi-based wholesale gold jewellery powerhouse, is launching its ₹33.83 crore IPO on February 4, 2026. With a massive revenue jump in FY25 and a footprint spanning 20 states, this blog explores whether the company's aggressive pricing and specialized manufacturing can deliver long-term value to investors.

Upcoming IPO

Upcoming IPO

1/28/2026

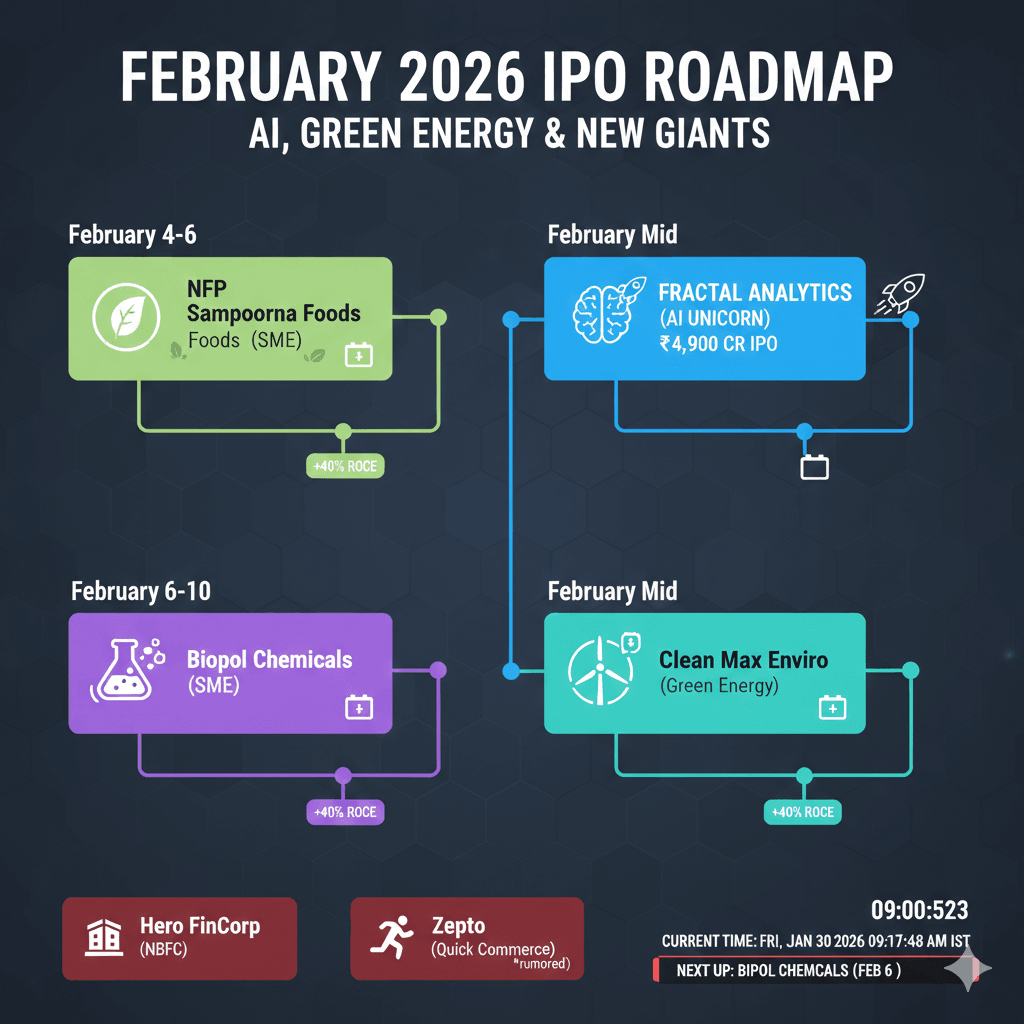

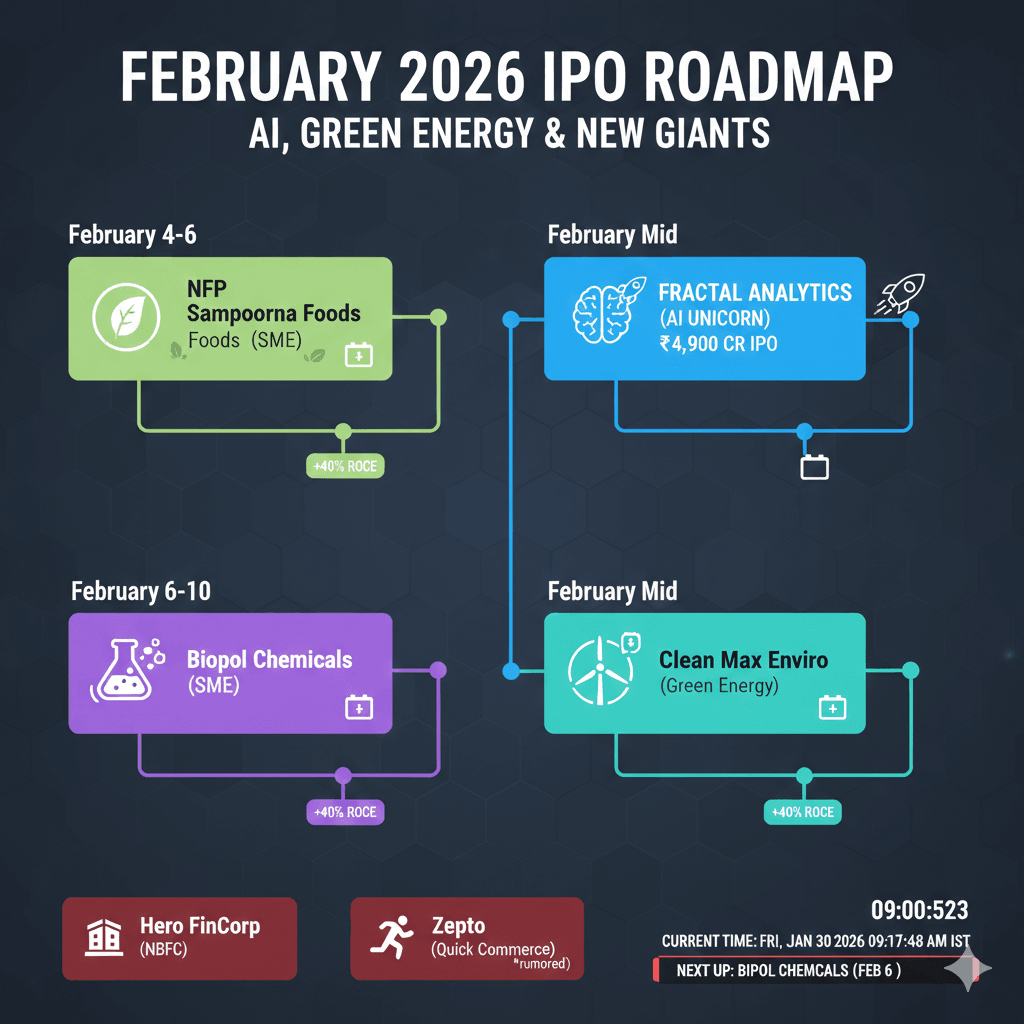

February 2026 is shaping up to be a historic month for the Indian stock market. While January was dominated by SMEs, February is the month where the "Heavyweights" are expected to take the stage.

Upcoming IPO

Upcoming IPO

1/29/2026

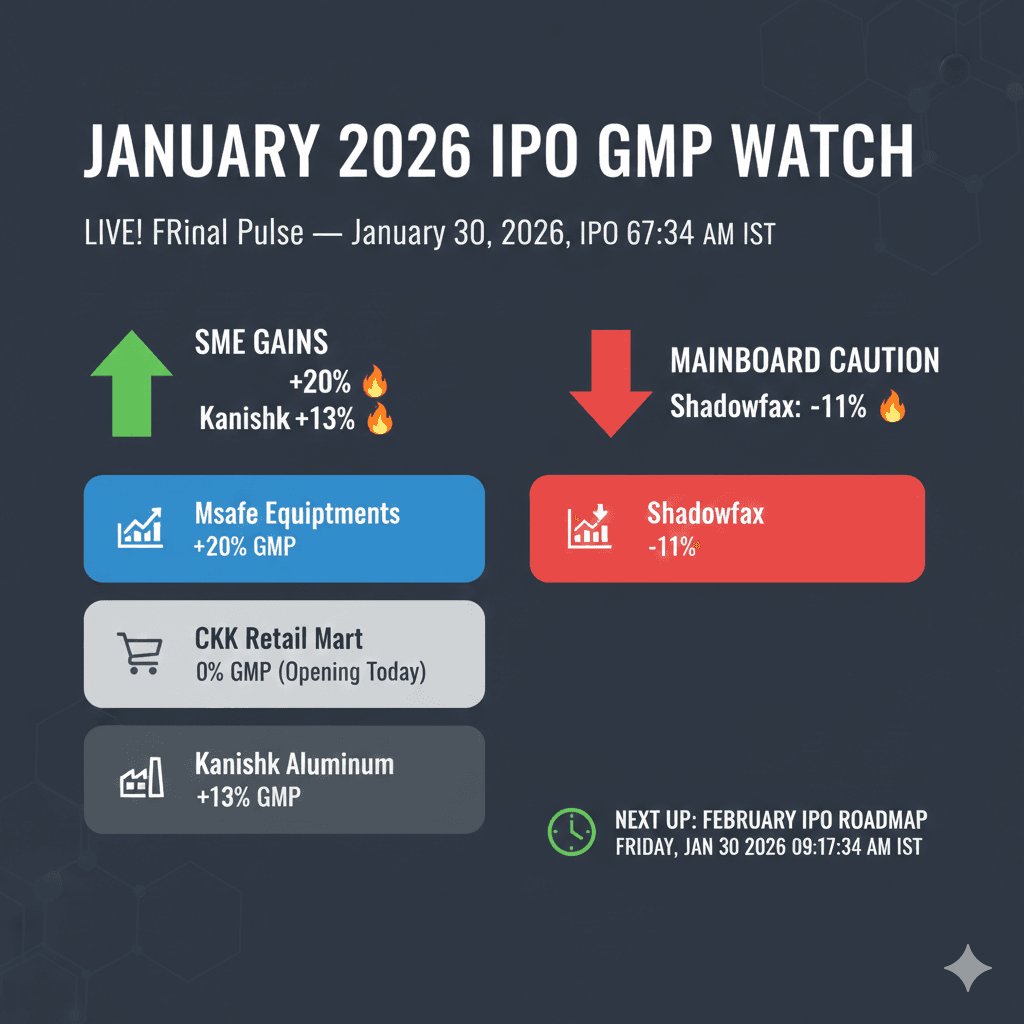

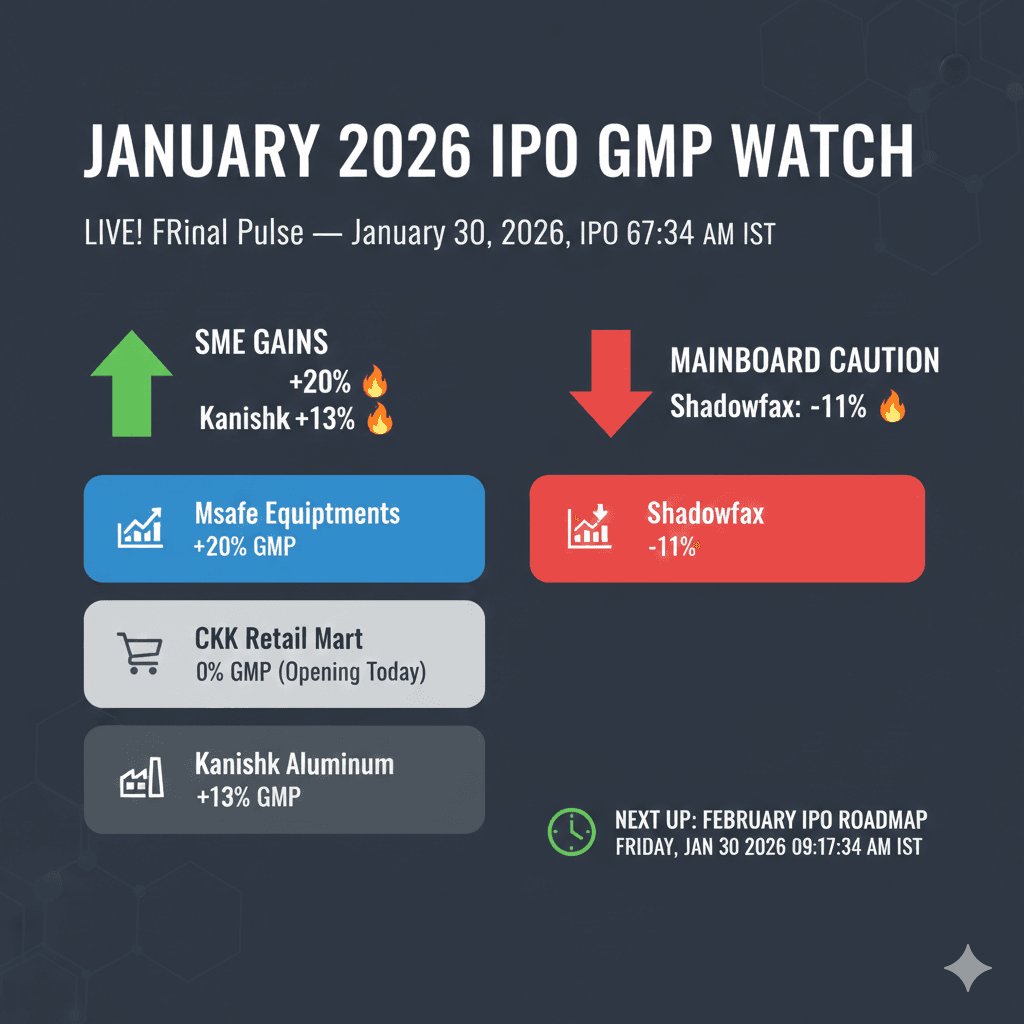

The Indian primary market is concluding January 2026 with a fascinating split in investor sentiment.

Open IPO

Open IPO

1/27/2026

Kanishk Aluminium India Limited, a Jodhpur-based manufacturer of aluminium extrusions and the name behind the premium "Baari" brand, is currently live with its ₹29.20 crore IPO. With the bidding closing tomorrow, January 30, this post analyzes the company's transition to a debt-free balance sheet, its growing presence in the solar and architectural sectors, and the current flat GMP status.

Open IPO

Open IPO

1/28/2026

Msafe Equipments Limited, a leader in aluminum scaffolding and height-safety solutions, is currently live with its ₹66.42 crore IPO. With the bidding ending tomorrow, January 30, this post breaks down the company’s impressive 48% revenue growth, its expansion into a new Greater Noida facility, and the current Grey Market Premium (GMP) as it targets a listing on the BSE SME platform.

Upcoming IPO

Upcoming IPO

1/24/2026

If 2025 was the year of the "Bumper Listing," 2026 is becoming the year of "Realistic Valuations." The recent performance of the Shadowfax IPO has served as a wake-up call.

Analysis

Analysis

1/29/2026

The final week of January 2026 has been a roller coaster for IPO investors. While the Shadowfax Technologies Mainboard IPO dominated headlines, its listing on January 28 told a cautionary tale.

Analysis

Analysis

1/24/2026

If you want to know where the world is going, follow the copper. In 2026, copper has hit all-time highs, surpassing $13,000 per metric ton.

Open IPO

Open IPO