The February 2026 Roadmap — New Names and AI Dreams

February 2026 is shaping up to be a historic month for the Indian stock market. While January was dominated by SMEs, February is the month where the "Heavyweights" are expected to take the stage.

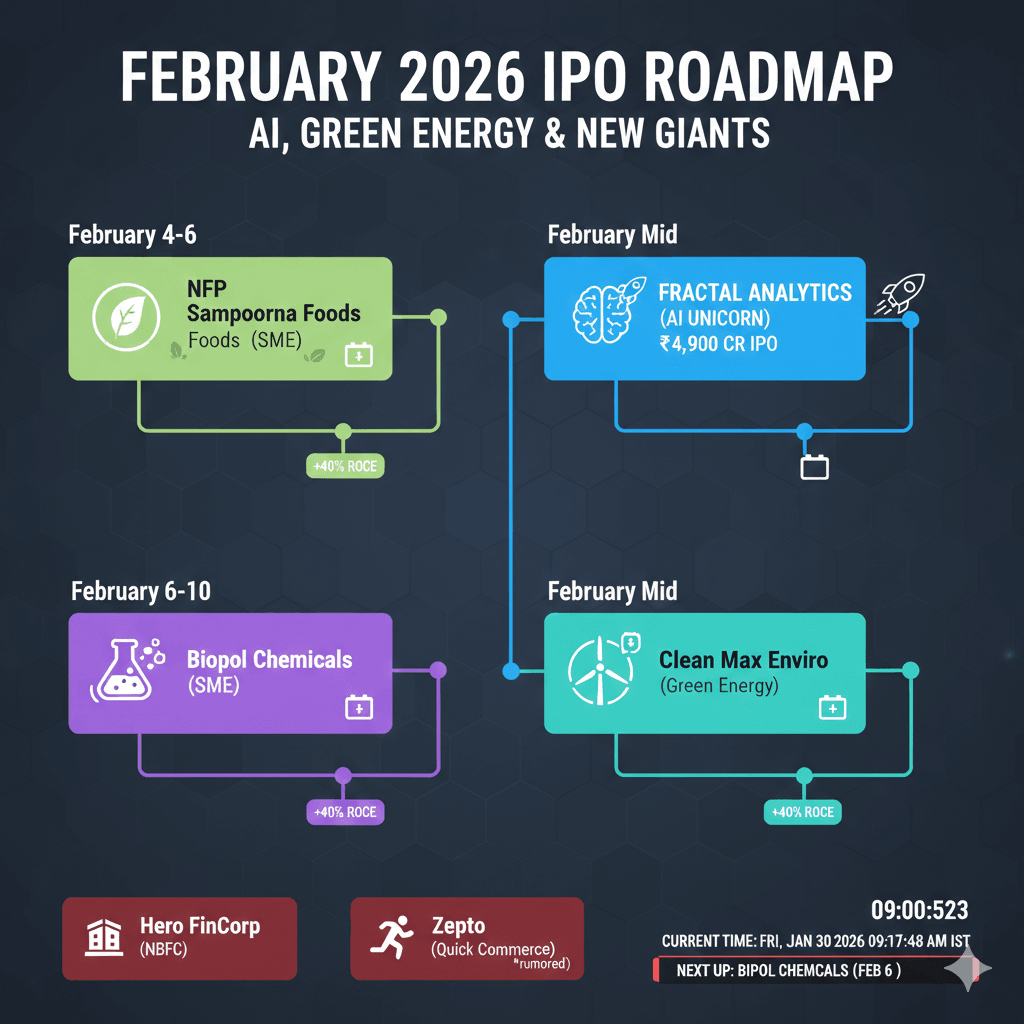

February 2026 is shaping up to be a historic month for the Indian stock market. While January was dominated by SMEs, February is the month where the "Heavyweights" are expected to take the stage. With several tech unicorns and renewable energy giants receiving SEBI’s final nod, the primary market is preparing for a fundraise that could exceed ₹15,000 crore in a single month.

1. The "February Rush" of 2026

February 2026 is poised to be a watershed month for the Indian IPO market. With over ₹15,000 crore in potential fundraises, the month is strategically positioned between the Union Budget and the fiscal year-end. This month's lineup is dominated by "High-Quality SMEs" and the first wave of AI-driven tech unicorns finally making their public debut.

2. NFP Sampoorna Foods: The Health-Tech Hybrid

Kicking off the month on February 4, NFP Sampoorna Foods is looking to capitalize on the healthy-snacking trend. With a price band of ₹52–₹55, it is a "bite-sized" IPO that is expected to attract massive retail participation. The company's focus on tech-enabled dry fruit processing has given it a niche that few other FMCG players currently occupy in the SME space.

3. Biopol Chemicals: The "Spec Chem" Star

Opening on February 6, Biopol Chemicals is the most fundamentally strong SME of the month. Boasting a 40.9% ROCE, this specialty chemical manufacturer is priced at ₹102–₹108. Given the global "China+1" supply chain shifts, Biopol is expected to see a significant GMP debut the moment its subscription window opens, with a tentative listing date of February 13.

4. Fractal Analytics: The AI Milestone

The biggest rumor in the market is the mid-February launch of Fractal Analytics. Expected to raise between ₹2,800 and ₹3,000 crore, this would be India’s first major pure-play AI listing. After returning to profitability in FY25, Fractal is the "trophy" IPO that global institutional investors have been waiting for, and its success will define the tech sentiment for the rest of 2026.

5. Clean Max Enviro: The Decarbonization Play

For the ESG-conscious investor, Clean Max Enviro Energy is the February heavyweight. Backed by Brookfield, this renewable energy firm is planning a massive ₹5,200 crore issue. As India pushes toward its 2030 green energy goals, Clean Max's commercial and industrial solar projects make it a "recession-proof" utility play that is expected to list toward the end of the month.

6. Hero FinCorp: A Financial Giant Returns

The NBFC sector will see its biggest shakeup with the Hero FinCorp IPO. With a proposed issue size of ₹3,668 crore, the company is targeting the massive MSME lending market. Analysts expect this to be a "long-term wealth creator" rather than a listing-gain play, appealing to those who want a piece of the Hero Group’s trusted legacy.

7. Zepto: The Quick-Commerce Wildcard

While not officially scheduled, the "market whispers" suggest that Zepto may file its final Red Herring Prospectus (RHP) in late February for a March launch. Any news on this front will likely trigger a massive shift in retail liquidity, as the quick-commerce battle between Zepto, Zomato, and Swiggy reaches its public market peak.

8. The Shift to "Fresh Issue" Dominance

A notable trend in the February 2026 roadmap is the dominance of "Fresh Issues" over "Offer for Sale" (OFS). Companies like Biopol and NFP Sampoorna are raising 100% fresh capital to expand manufacturing. This is a bullish signal, as it means the money is going back into the business for growth rather than just providing an exit for early investors.

9. Market Sentiment: The "Post-Budget" Rally

February's IPO success is heavily dependent on the market's reaction to the Union Budget. If the budget favors infrastructure and green energy, expect Clean Max and Kanishk Aluminium (listing Feb 4) to see significant post-listing momentum. The current "bullish" undercurrent suggests that investors are ready to deploy fresh capital.

Conclusion: Strategizing Your February Bids

With so many overlapping dates, February will require "Lottery Management." Don't put all your capital into one issue. Spreading applications across high-GMP SMEs like Biopol and fundamentally strong Mainboards like Fractal will be the key to a profitable month. Keep your demat accounts ready—February 2026 is going to be a wild ride.