The Final Pulse — January 30, 2026, IPO GMP Watch

The Indian primary market is concluding January 2026 with a fascinating split in investor sentiment.

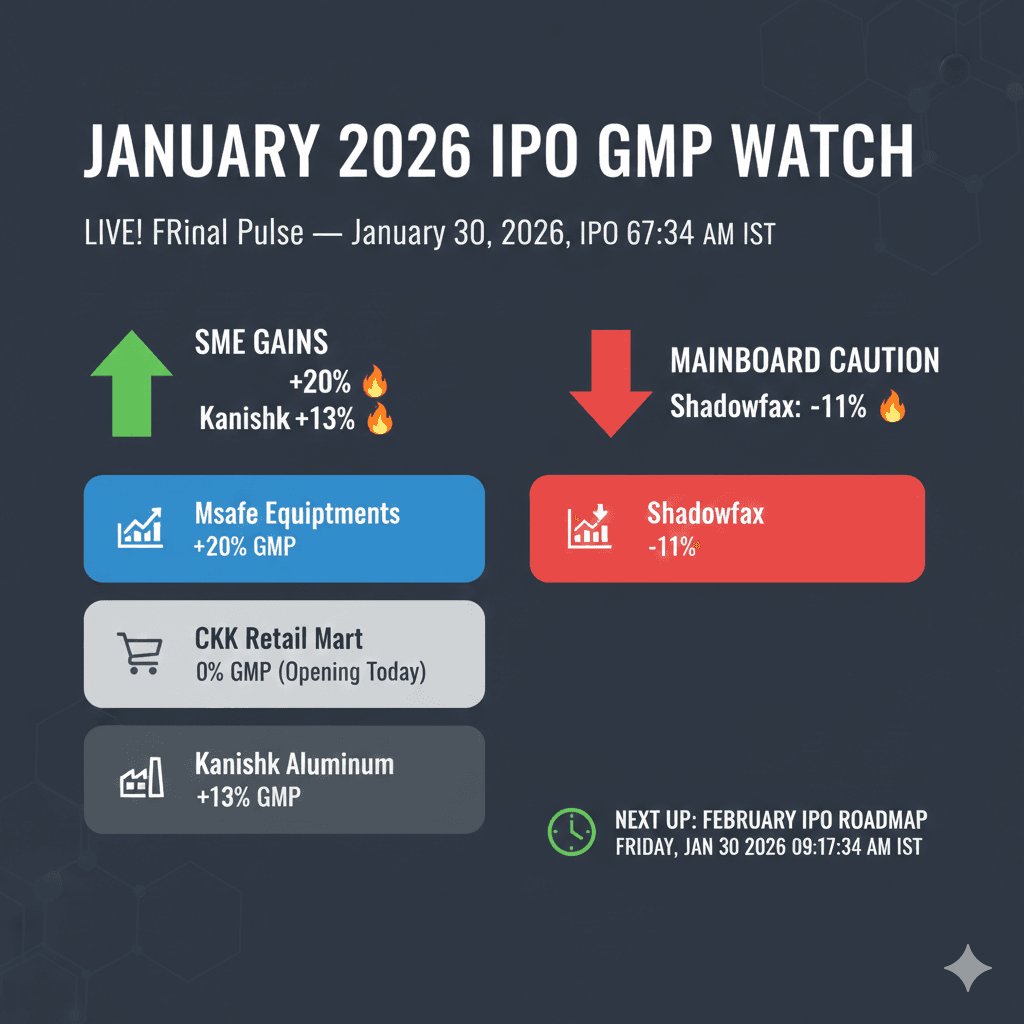

The Indian primary market is concluding January 2026 with a fascinating split in investor sentiment. While Mainboard IPOs have faced a reality check with several listing at discounts, the SME (Small and Medium Enterprise) segment is currently the playground for high-risk, high-reward trading. As of today, January 30, the Grey Market Premium (GMP) is acting as a critical, albeit volatile, compass for thousands of retail investors trying to spot the next "multibagger."

1. The Grey Market Paradox: SME Success vs. Mainboard Caution

As we wrap up the final trading day of January 2026, the IPO market is experiencing a sharp divide. While recent Mainboard listings like Shadowfax Technologies disappointed with an 11% listing-day discount, the SME segment continues to attract aggressive speculators. The "Grey Market Premium" (GMP) is currently the only signal investors are following to distinguish between a potential "multibagger" and a listing-day trap.

2. Msafe Equipments: The "Golden Child" of January

Msafe Equipments is the undisputed star as its subscription window closes today. With a price band of ₹116–₹123, its GMP has shot up to ₹25, suggesting a massive 20.3% listing gain. Retail investors have flooded the issue, with the retail portion subscribed over 15x already. This surge is backed by the company's doubled profit margins in FY25, making it the most high-conviction play of the week.

3. Kanishk Aluminium India: A Steady Infrastructure Bet

In the fixed-price category, Kanishk Aluminium is offering a more stable alternative. Priced at ₹73, it currently commands a GMP of ₹10, or roughly a 13.7% premium. Unlike the more volatile tech-linked SMEs, Kanishk’s focus on industrial aluminium extrusion provides a fundamental floor that has kept its premium steady even as the broader market faced minor corrections this week.

4. CKK Retail Mart: The Agricultural Giant Opens

Opening today, January 30, CKK Retail Mart is the largest SME issue of the week at ₹88 crore. Because of its large size, the GMP is currently flat at ₹0. However, historical patterns in 2026 show that these "packaged agro-commodity" stocks often see a late-stage premium spike on the final day of bidding (February 3) once the institutional "anchor" investors are revealed.

5. Accretion Nutraveda: Fundamentals Over Fomo

Accretion Nutraveda is closing today with a relatively muted GMP of ₹2–₹5. While the premium is low, the company’s expansion into automated manufacturing for nutraceuticals makes it a "value" pick. Most analysts expect a listing near the upper price band of ₹129, proving that not every successful IPO needs a sky-high grey market buzz to be a long-term winner.

6. Mapping the Allotment: February 2nd is the Key

For those bidding today for Msafe, Kanishk, or Accretion, the most critical date is Monday, February 2. This is when the "Basis of Allotment" will be finalized. With oversubscription levels hitting record highs, the "Kostak Rate" (the price paid for an entire application) is becoming the primary way for large investors to hedge their bets before the official listing.

7. Registrar Reliability: Where to Check Your Status

In 2026, the "allotment lottery" is being handled by three major registrars. For Msafe, you will need to head to Maashitla Securities, while Kanishk and Accretion are being managed by KFin Technologies. Ensuring you have your PAN and Application Number ready for these specific portals on February 2 is the first step toward securing your listing-day profits.

8. The Shadow of Shadowfax: A Warning for Speculators

Investors are still cautious after Shadowfax listed at ₹112.60 against an issue price of ₹124 earlier this week. This "listing at a discount" despite a positive GMP has reminded 2026 traders that the grey market is an informal sentiment gauge, not a guarantee. It has forced a shift toward looking at "Subscription Multiples" as a more reliable indicator of listing-day performance.

9. SME Subscription Strategy: The 10x Rule

A new trend for 2026 has emerged: unless an SME IPO is subscribed at least 10x in the NII (HNI) category, the GMP rarely holds up on listing day. As of today, Msafe has easily cleared this hurdle, while CKK Retail is just beginning its journey. Following the live subscription data on the NSE/BSE websites is now just as important as tracking the GMP.

Final Verdict: Where to Put Your Money

If you are looking for immediate listing gains, Msafe Equipments remains the strongest candidate. For those looking for steady industrial growth, Kanishk Aluminium is the pick. However, for the cautious investor, holding cash for the "Giant" Mainboard IPOs coming in February might be the most prudent move as January liquidity begins to dry up.